Coronavirus Resource Directory for Landlords and Tenants

A definitive resource for landlords and renters to find the answers to questions regarding COVID-19, rights and protections, government announcements, and tools. Published and maintained by Avail.co How Coronavirus Spreads The virus that causes COVID-19…

Coronavirus Resource Directory for Landlords and Tenants

The places where homeownership is leading to the largest wealth gains

- San Jose-Sunnyvale-St. Clara, Calif.: $929,471

- San Francisco-Oakland-Hayward, Calif.: $761,204

- Anaheim-Sta. Ana-Irvine, Calif.: $509,806

- Los Angeles-Long Beach-Glendale, Calif: $430,196

- San Diego-Carlsbad, Calif.: $427,896

- Urban Honolulu: $412,986

- Naples-Immokalee-Marco Island, Fla.: $379,243

Boston plan for shifting police funds a template to help affordable housing

Housing gap between white and black homeowners still isn’t closing

6 Top Podcasts on Fair Housing

1. The Fair Housing Podcast Questions and Answers

This fairly new podcast from Offit Kurman Attorneys At Law focuses on the slew of convoluted questions and issues that circle the problems akin to fair housing. As they say, “For residents, housing free from unlawful discrimination is a right; for landlords, it’s the law.” Join hosts John Raftery and Revée Walters as they discuss the matter and answer a variety of questions in order to ensure both landlords and property managers are well aware of the fundamentals of fair housing. The perspective from attorneys is a great resource for landlords and managers who want to support fair housing and help their tenants live comfortably and safely. To no surprise, each episode of The Fair Housing Podcast centers around fair housing, but here are two recommended episodes to get started with: Episode 12: Fair Housing Liability This episode highlights accountability issues surrounding fair housing, specifically if you could be sued or not if you violate fair housing as a landlord or property manager. Episode 10: Familial Status This episode focuses on how to not discriminate against families with children.2. Shop Talk: The Real Estate Show

Shop Talk, brought to us by The CE Shop, has the goal of bettering real estate agents. They interview industry experts, ask the tough questions, and chat about unique real estate related subjects. “Real estate’s a dynamic industry, and we know you have interesting stories to tell about it,” they announce. While Shop Talk has some excellent episodes focusing on anything from 17-year-old real estate agents to haunted houses, this recent episode on fair housing is a great resource for real estate agents specifically: Episode 48: Fair Housing Real estate and equal opportunity for housing are forever intertwined, especially since the Fair Housing Act was enacted in 1968. This episode breaks down the most frequent fair housing violations, how and why those laws are so important, and how real estate agents can provide the best experience to everyone looking for a home.3. Selling St Pete with Nicole Saunches

Nicole Saunches’ podcast, Selling St Pete, is a one-stop-shop for anything real estate related in and around St. Petersburg, Florida. Nicole offers useful information for both current and potential homeowners, whether you’re on the buying or selling end of the process. Saunches works for Coastal Properties Group International, which has been one of Tampa Bay’s most successful real estate companies since they opened their doors in 2012. In 2019, they sold 145 homes that were over $1 million, so it’s safe to say Nicole’s advice when it comes to real estate is trustworthy. Nicole covers topics ranging from new construction to hurricane preparation. But in one of her most recent episodes, fair housing is the star of the show: Episode 32: Know Your Rights...A discussion about Fair Housing for all In this episode, Nicole Saunches is joined by two members of the Pinellas County Office of Human Rights – Jeffrey Lorick and Paul Valenti. They chat about fair housing from A-Z while reflecting on a recent training with the Pinellas Realtor Organization. The training, which Nicole claims was “one of, if not the best, training I have experienced in my real estate career,” specifically aimed attention on how constant bias can have a huge impact on Fair Housing laws.4. TenantCloud: Property Management Podcast

TenantCloud is an all-in-one software that assists landlords with all things property management, so they’re clearly pros when it comes to the rental industry. Their podcast covers real estate, investment, DIY tips, news/laws, and likely anything else rental industry connected that comes to mind! With extremely useful information for landlords, such as insight into rental fraud and how the pandemic has shaped the real estate industry, it’s no wonder this podcast has nearly 5 stars. Each episode offers highly relevant advice for those who manage properties, but this episode from March 2020 clues landlords into specifics of the Fair Housing Act: Season 2, Episode 9: What Landlords Are Excluded from the Federal Fair Housing Act? Surprisingly enough, depending on the local, county and state laws, some landlords aren’t required to abide by the Federal Fair Housing Act. In this episode, TenantCloud discusses those specific scenarios and how crucial it is to follow Fair Housing laws, even if you may be absolved.5. Selling Richmond: The Civic REALTOR®

This bimonthly podcast brought to us by the Richmond Association of REALTORS® follows different leaders in the Richmond area and the big decisions they make that directly affectrealtors and their clients. Host Joh Gehlbach, the Government Affairs Coordinator of Richmond Association of REALTORS®, chats with different directors and leaders of sorts in each episode to explore their recent accords in regard to the real estate industry. All 14 episodes present valuable insight into how so many considerable choices made by people in power have an impact on those around them and their community. This most recent episode is particularly pertinent as it references a recent law: Episode 14: Source of Income in the Virginia Fair Housing Act In this episode, Gehlbach talks with the Director of Fair Housing at Housing Opportunities Made Equal of Virginia (HOME), Alex Guzmán. The two chat about source of income, as it is now a protected class in the Virginia Fair Housing Act as of July 1, 2020. Guzmán shares the relevance of this new law and how it broadens housing opportunities in Virginia.6. The Holistic Housing Podcast

This podcast is created by NACCED, the National Association for County Community and Economic Development. It focuses on the politics of housing which, of course, highlights affordable and fair housing consistently. Each episode features policymakers and program implementers who are involved in community and economic development, as well as affordable housing. The different high-profile guests on the podcast discuss their experience, goals, and solutions on topics ranging from workforce development to homelessness. The hosts, Sarah and Laura, hope to show their audience how housing affects not only one’s quality of life, but the ability to lead a fruitful life. While this podcast is highly educational, it is also a hoot and the hosts offer some humor to help balance the seriousness of each topic. Much like most of the podcasts on this list, each episode is relevant to fair housing, but this episode from March 12 of this year highlights NLHP, the National Housing Law Project: Alt 137 In this episode, Noelle Porter, NLHP Director of Government Affairs, chats with Sarah and Laura about tenants’ rights. NLHP’s group of legal aid attorneys work every day to fight discrimination and support low-income renters that are facing eviction, which is especially significant now as so many tenants are struggling to pay their bills amidst the pandemic. Whether you’re a homeowner, dreaming of becoming a homeowner or property owner, a renter, a landlord, or just looking for ways to help create fair housing opportunities in your area, these podcasts will educate you while entertaining you. If books aren’t your thing and you’re sick of sitting in front of a screen for hours on end, podcasts offer conversational intellect that will keep you in the know when it comes to fair housing in America. These shows and episodes in particular do an exemplary job of breaking down some hard to digest information, allowing you to easily understand critical knowledge and materials that are necessary to understand whether you’re involved in the real estate industry, or simply curious about these trending topics. Just as you dream of the perfect, comfortable home, others do as well across all walks of life and socioeconomic statuses (SES). Let’s do whatever we can to ensure all citizens receive fair housing and live a comfortable life. [rsnippet id="7" name="Global Article Footer"]COVID-19 Forbearance plans extended for Federal-backed mortgages

Does it still make sense to put down 20% when buying a home?

But the notion that homebuyers need to put down 20% is a common misconception. There are lenders that can help you get a mortgage if you don’t have that much saved for the down payment. Depending on your situation, it may even be possible to get a mortgage without putting any of your own cash on the line.

However, just because you can potentially buy a house or apartment without putting down 20% doesn’t mean you necessarily should. Let’s take a look at the advantages and disadvantages and see if it still makes sense to make a 20% down payment when you buy a home...

[rsnippet id="7" name="Global Article Footer"]

An avalanche of evictions looms in N.J. Renters and landlords say it’s only going to get worse.

…Although tenants can’t be locked out for non-payment, the moratoria do not abate or cancel out their rent, and non-paying tenants fall deeper in debt every first of the month. The analysis by Stout estimated…

An avalanche of evictions looms in N.J. Renters and landlords say it’s only going to get worse.

The analysis by Stout estimated the total amount of unpaid rent through January in New Jersey could be as much as $832 million.

Advocates note that the money is owed largely by tenants who fell behind in the first place because they had lost their jobs and much or all of their incomes.

“Just because a moratorium ends doesn’t mean everybody’s got their job back, and a great many people are going to have trouble paying their rent going forward,” said Matt Shapiro, president of the New Jersey Tenants Organization...

[rsnippet id="7" name="Global Article Footer"]

More than $100 million sitting unspent in program meant to help pay rent, utilities

The HOPE Grant program was announced by N.C. Governor Roy Cooper in October. By giving money to qualified applicants to pay rent, organizers hoped to help people struggling financially stay in this homes and also help landlords who depend on rental income.

On Thursday, Cooper and State Budget Director Charlie Perusse touted the program as a success in a press conference unveiling the governor’s budget proposal for this year.

“The HOPE Program that the Governor mentioned is a leader in the country. We were actually out in front of the federal government on this,” Perusse said of the program.

“The program received about $200 million in requests and we currently have gotten out about $125 million of that.”

But the program has spent less than half that amount, according to the agency administering the program...

[rsnippet id="7" name="Global Article Footer"]

How will President Biden’s American Rescue Plan Affect You?

PAYMENTS TO INDIVIDUALS

Larger Stimulus Checks: The Plan calls for another $1,400 in stimulus money to be sent to eligible taxpayers. Unlike the first stimulus last summer, adult dependents will also receive a check, as will families with mixed immigration, as spouses of undocumented immigrants were left without a check last summer. Greater Unemployment Assistance: Those without jobs will get a federal boost of $400 a week in their unemployment checks, an increase from the $300 boost approved by Congress in December. In addition, individuals in the Pandemic Unemployment Assistance Program and those in the Pandemic Emergency Unemployment Compensation Program who have ran out of state money, will be eligible for this weekly boost. Aid for the Hungry: The Plan calls for the extension of the 15% food stamp benefit increase from June through September. Additionally, there is $3 billion in aid that would go to helping women, infants and children (WIC) purchase more food and an additional $1 billion in nutrition assistance for U.S. Territories. The Plan also calls for a public/private partnership between the federal government and restaurant owners to provide food for Americans in need and jobs for restaurant workers who have been laid off during the pandemic. Child Care Assistance: The Plan earmarks Congress to create a $25 billion emergency fund and add $15 billion to an existing grant program to help childcare providers pay for rent, utilities, and payroll, and other increased costs associated with the pandemic such as personal protective equipment.HOUSING

Rental Assistance: The Plan will allocate an additional $25 billion on top of the $25 billion approved in December, to provide funding for low- and moderate-income households who lost their jobs during the pandemic and who are struggling to pay the rent. Additionally, it will provide another $5 billion in funding to help renters-in-need to pay their utility bills and $5 billion to stop those on the brink of homelessness from losing their home. Eviction Moratorium: The Plan extends the federal eviction moratorium through the end of September and allows for mortgage forbearance applications to be applied for through September 30 as well, as long as the mortgage is federally guaranteed.TAXES

Increase in Child Tax credits: The Plan will increase the childcare tax credit for one year so that families will get back up to 50 percent of the money spent on childcare for any child under the age of 13. Additionally, there is going to be a temporary increase in the Child Tax Credit to $3,600 for children six-years-old or younger and $3,000 for children between the ages of six and 17 for one year. The credit is also fully refundable. Increase to the Earned Income Tax Credit: The Plan raises the maximum Earned income Tax Credit to $1,500 for one year for adults without children, increase the income limit for the credit to $21,000 and expand the eligible age to help cover older workers.HEALTH

Subsidize Health Insurance Premiums: The Plan compels Congress to subsidize the premiums for individuals who lost their work-based health insurance through the end of September. Additionally, it expands the premium subsidies of the Affordable Care Act where those enrolled wouldn’t have to pay more than 8.5% of their income for coverage. It also requires Congress to fund $4 billion for mental health and substance use disorder services while adding an additional $20 billion for veteran health care needs. Bringing Back Emergency Paid Leave: The Plan is reinstating paid sick and family leave benefits that expired in December, through September 30. This benefit will also be extended to large businesses (more than 500 employees) and small businesses (fewer than 50) and add federal workers who were ineligible with the original program. The Plan provides 14 weeks of paid leave for individuals who are sick, quarantining, or caring for a child whose school is closed. Businesses with fewer than 500 employees would receive a 100 percent reimbursement from the government. More support for vaccines and testing: The Plan provides a $20 billion investment in a national vaccination program that would create vaccination centers in communities across the country and provide mobile units in areas that are harder to reach. An additional investment of $50 billion will go toward testing, providing funds for rapid testing, expanded lab space and have regular testing implemented at schools so they can reopen sooner and safer. This should create 100,000 new public health jobs, which, if it comes to fruition, would practically triple the current workforce. This investment also expands community health centers and health services on tribal land and supports long-term care facilities and prisons to prevent outbreaks.ECONOMY

Grants for Small Businesses: The Plan provides $15 billion to create a new grant program for small businesses that is separate from the Paycheck Protection Program. It also invests $35 billion in state, local, tribal and non-profit programs to provide low-interest loans and venture capital for those looking to start a business or invest in one. Provide assistance for states and schools: The Plan will send $350 billion to state and local governments to keep frontline workers employed, distribute the vaccine more rapidly, continue to increase testing and get schools reopened. Additionally, $20 billion is be appropriated for hard-hit public transit agencies to prevent layoffs and route elimination. Meanwhile, $170 billion is earmarked for elementary, high schools and colleges and universities to help them reopen safely or continue to facilitate remote learning. Increase Minimum Wage: The Plan will have Congress approve a minimum wage increase to $15 an hour, eliminate tipped minimum wage and the sub-minimum wage for individuals with disabilities.Unpaid landlords say they can’t pay their bills –or get new tenants

Sheriffs on the Island haven't carried out residential evictions since March, when the state began curtailing court activity in the early days of COVID-19.

With the virus straining many industries, thousands of Long Islanders have lost jobs and are struggling with basic expenses like rent. The government passed policies and bolstered benefits designed to protect renters. Only a fraction of that relief has reached landlords, and some small property owners are reeling...

[social_warfare]

The January jobs report was disappointing, could that hurt the housing market?

While the number of workers on temporary layoff dropped in January, there was little change in the 3.5 million Americans who have been laid off permanently. In addition, four million Americans are still long-term unemployed, jobless for 27 weeks or more. Industry experts and analysts largely agree that moderate jobs growth like this reflects just how driven the economic recovery is by the ongoing COVID-19 pandemic. The question now, as widespread vaccination efforts get underway, is whether we will see a steady and accelerating recovery through the remainder of the year, or if we will be plagued with small increases and decreases in unemployment until herd immunity is achieved.

[rsnippet id="7" name="Global Article Footer"]

Rental Assistance Program: Good news for tenants and possibly landlords

The recently enacted $2.3 trillion Consolidated Appropriations Act, 2021(the Act), which combined a $900 billion coronavirus relief bill as part of a larger $1.4 trillion omnibus spending and appropriations bill for the 2021 federal fiscal…

Rental Assistance Program: Good news for tenants and possibly landlords

In particular, Section 501 of Subtitle A of Title V of Division N of the Act establishes the “Emergency Rental Assistance program” (ERA), which appropriates $25 billion through the U.S. Department of the Treasury (Treasury) to provide eligible households with direct financial housing assistance. The enactment of the ERA provides landlords, tenants, borrowers, potential buyers, financial institutions and small businesses with a necessary lifeline to weather the ongoing economic fallout from the COVID-19 pandemic.

[rsnippet id="7" name="Global Article Footer"]

Landlords pandemic protocols range from strict to laisse-faire

Policies at Southstar Lofts in Center City, where she lived until last month, had made her feel as safe as she could feel while COVID-19 cases skyrocketed and she called a multifamily building home. The apartment has increased cleaning in shared spaces, asked residents not to ride elevators with people from different households, and removed chairs from the lobby to discourage lingering, among other policies. Signs remind everyone that masks are mandatory, and people should keep their distance.

Easing first-time homebuyers’ fears

Most buyers use agents who are referred by friends or family members.Jason Gutierrez with Berkshire Hathaway HomeServices, Don Johnson REALTORS® has spent more than a decade helping first-time homebuyers in the San Antonio area navigate the process. Gutierrez said 80 percent of his clients are first-time homebuyers. I recently talked to him about the local real estate market and how he helps his clients prepare to become homeowners.

What Landlords Should Know about the COVID-19 Rent Relief Act

Congress attempted to help landlords indirectly in the original CARES Act, by making money available for rent relief. However, there wasn’t sufficient money, tenants were at a loss where to go to ask for such relief, and some tenants had no incentive to even ask for relief. The $900 billion December 2020 COVID-19 relief bill includes $25 billion for the Emergency Rental Arrears Program (ERAP). The new law allows landlords to apply for the tenant, if necessary. Both the tenant and landlord will benefit from this new rent relief law.

When then-President Trump signed the new COVID-19 relief bill into law, the Department of Treasury took quick action on the rent relief money.

Within days, a deadline of January 12, 2021, was set for eligible state and local governments to apply for money. An eligible local government is any such entity with a population of at least 200,000...

[social_warfare]

10 Facts for Millennials During Their 2021 Homeownership Journey

Compiled by Benton Capital Mortgage Lending, here are 10 solid housing and mortgage facts about the 2021 market that are encouraging to read as many Millennials stick to their homeownership hopes and dreams and stay ahead of the pack.

[social_warfare]

Mortgage Tailwinds and Headwinds

First-time homebuyers are important because they take a housing unit from the market, but don’t give one back, creating pure growth in homeownership. Over the past five years, the first-time homebuyer segment has grown tremendously. However, they have not been immune to the impact of the COVID-19 pandemic. To best support the health of this important segment of the housing market in the New Year, it’s helpful to have an idea of what first-time homebuyers have going for—and against—them.

[social_warfare]

Existing home prices increase in every tracked metropolitan area in the U.S.

That’s because home prices went up everywhere at the end of 2020. And when we say everywhere, we mean everywhere.

According to data from the National Association of REALTORS® (NAR), existing home prices rose in all 183 metropolitan areas that are tracked in the fourth quarter of 2020. And in 88 percent of those markets, there were double digit price gains.

BY comparison, 115 of the metropolitan areas saw price growth in the third quarter.

“The fourth quarter of 2020 presented circumstances ripe for home price increases,” Lawrence Yun, NAR chief economist told CNN. “Mortgage rates reached record lows, thereby driving up the demand. At the same time, inventory levels also reached record lows, leading to grim inventory conditions of insufficient supply in the fourth quarter.”

The national average mortgage payment on an existing single-family home increased by $20 per month from $1,020 to $1,040 from the fourth quarter of 2019. This means the national average family income needed to afford a home also increased by nearly $1,000, from $48,960 in the fourth quarter of 2019 to $49,908 in the fourth quarter of 2020.

The Metro areas that saw the biggest increase were mostly in the Northeast corridor of the country, as well as in Florida. Neither location is surprising, but there were also big gains in Washington and Idaho, which may be a little less expected.

Bridgeport, Conn. saw the biggest increase, with prices jumping 40% in one year. Pittsfield, Mass. (32%), Naples, Fla. and Atlantic City, N.J. (both 30%) were the others that jumped by such a large margin.

Increases between 24% and 29% were identified in Crestview, Fla. (29%), Barnstable, Mass (29%), Boise City, Idaho (27%), Spokane, Wash. (24%), Kingston, N.Y. (24%), and Binghamton, N.Y. (24%)

What’s noticeable about this list is it appears the attraction for the purchase of existing homes seems to be hottest in areas that are within driving distance to a major metropolitan area but may be far enough out to provide a more affordable option, or are part of a vacation destination, which could mean buyers are thinking of these homes as potential investment properties.

The other possibility, Yun said, is that with more and more companies allowing employees to work from home, either part-time or full-time, these locations are more desirable to own a home, as you can be away from the hustle and bustle and still do your job.

It’s a true have “your cake and eat it too” situation for homebuyers.

Not surprisingly, the most expensive areas of the county to live were in California, specifically the Silicon Valley. Here, the median home sale price in San Jose is $1.4 million. San Francisco was the only other city with a median price north of a million bucks ($1.14 million), but Anaheim is getting closer ($935,000).

Rounding out the top 10 most expensive metropolitan areas are Honolulu ($902,500), San Diego ($740,000), Los Angeles ($688,700), Boulder, Colo. ($661,300), Seattle ($614,700), Nassau County, N.Y., or the suburban part of Long Island ($591,600) and Boston ($579,100).

Boulder was the only Metro in the top 10 that didn’t see a double-digit percentage price increase.

While this has been a boon for those looking to sell, the tipping point for buyers might not be far off, and prices will have nowhere to go but down.

“The average, working family is struggling to contend with home prices that are rising much faster than income,” Yun told CNN. “This sidelines a consumer from becoming an actual buyer, causing them to miss out on accumulating wealth from homeownership.”

[social_warfare]

Family and Friends Helping First-Time Homebuyers with Their Down Payment

Biden’s housing agenda starts with fair housing initiative

How Does the Affordable Housing Crisis Impact Our Communities? These 4 Documentaries Will Show You

You can spend hours Googling how-to articles on homeownership, but we’ve rounded up these four documentaries on affordable housing to provide you with a one-stop-shop for all relevant information about homeownership. Not only do these…

How Does the Affordable Housing Crisis Impact Our Communities? These 4 Documentaries Will Show You

Not only do these documentaries highlight affordable housing across the United States, they also have a large focus on ending the housing crisis across the globe and the homelessness calamity, particularly amongst America’s youth in VICE’s documentary ‘Shelter’.

Read on below to understand the focus of each of these recommended documentaries:

Transformation of Affordable Housing in Rural Areas of the U.S.

This short documentary produced by Greystone focuses on how USDA’s Rural Development Division, and partners, have been working to conserve affordable housing for elderly and low-income residents in rural America. In the film, experts such as Robert Barolak of Greystone discuss the affordable housing preservation process. “There are still a great number of lower-income and elderly folks who live in rural America and who need affordable housing. But it’s aging. It’s deteriorating, and some of it deteriorating quite rapidly. It needs to be renovated and refreshed. It needs to be repositioned for the next 30 or 40 years,” Barolak shares. Greystone has taken that into account and made active changes both financially and in regard to redevelopment.

Greystone manages the repositioning and renovation of apartment complexes in small rural rental communities across the country, primarily in the southeastern states. As Tanya Eastwood, the president of Greystone Affordable Development, shares the company’s plans, “We came up with a creative innovative plan to preserve this much-needed housing. We basically pooled them together in a statewide portfolio type transaction and are able to have a major impact in their real estate schedules that they own.” Recently, Greystone was able to refurbish 1,362 apartments in 44 different communities across rural Georgia with $117 million in financing. In addition to USDA, Greystone actively worked with the Athens Housing Authority, Georgia Department of Community Affairs, and Fannie Mae to assemble the necessary financing.

Sold Out: Affordable Housing at Risk

This PBS documentary was produced with the MN Housing Partnership and shares numerous stories from tenants on how they pushed through the housing crisis to find affordable solutions. Ever-changing economic power and urban development have been closing in on low-income communities for ages, and in turn, negatively impacting the affordable housing market. With each passing day, low-income residents have fewer options when it comes to housing and once we see those families and residents move to more affordable areas, local businesses start to see the lack of patrons immediately and struggle to make ends meet. As shared in the documentary, “Folks at the bottom end of the income spectrum are losing out in this very competitive situation.”

One heart-wrenching example, tenants who had called their Richfield, MN apartment home for up to 15 years received 30-day notices that they had to leave, even after signing 12-month leases, once the complex was sold. The new owners of the huge apartment complex, Crossroads Apartments, immediately put in a set of policies designed to ultimately remake the tenant population, such as increasing rents 30% and stopping all involvement in any government programs.

This vicious cycle seems to be never ending, but ‘Sold Out: Affordable Housing at Risk’ shares solutions to the crisis and eviction scares. The short film also touches on communities of color, asking important questions such as “Is what’s wrong the concentration of communities of color, or is it the way in which we treat concentrations of communities of color?” As said in the documentary, “This issue of housing sits at the center of our wellbeing.”

SHELTER

VICE’s documentary ‘SHELTER’ focuses on America’s youth homelessness crisis specifically. The crew set off to New Orleans to chat with the staff and residents of America’s largest non-profit shelter – Covenant House. The perspective from the alarmingly young residents and passionate staff in the documentary shines a light on the severity of the issue and ultimately prompts directors Brent and Craig Renaud (as well as viewers) to urgently address the plight of homeless youth.

The Covenant House has been protecting at-risk youths for over 40 years and has no plans of stopping. The documentary informs viewers of the day to day struggles the staff handles to keep vulnerable members of society safe and off the streets. With a large majority of these teens being survivors of sex trafficking, physical abuse, mental health issues, addiction, and abandonment, the Covenant House isn’t just a place to lay their head, but a home. Homelessness affects over half a million people in the U.S. and the number of unhoused people increased nationally for the first time since 2010, based on data from the U.S. Department of Housing and Urban Development (HUD). In Louisiana specifically, where the short film is based, at least 3,000 unhoused people were reported in 2017.

High Quality and Affordable

This documentary from Gaaleriie centers on affordable housing in Vienna, which is nearly a utopian community when it comes to social housing. Vienna currently has two systems of subsidized housing. One is social housing, owned by the city, where no new private units are built within this sector. The nonprofit sector has been greatly strengthened over the years by working with nonprofit developers such as this one. Roughly half of the population is living in this sector of public housing. Within this subsidized sector, there is a lot of experimentation allowing them to introduce new sustainable housing standards such as energy consumption and integration programs to assist immigrants in Vienna.

Another aspect of Vienna’s affordable housing, which makes them the star pupil of the world, is that every large new housing estate has to go through an in-depth competition process. A team consisting of a nonprofit developer, an architect, a landscape architect, and other experts have to present a “complete product” to the city. These extensive steps ensure that the appropriate amount of time, effort, and consideration has been put into the new development to guarantee it is a safe and beneficial home for those who are seeking affordable housing.

Each of these four documentaries highlight obstacles that the housing crisis puts on lower income populations. A lack of affordable housing doesn't only leave people unhoused, but it also has a huge impact on small businesses, schools, and the overall community. The U.S. can certainly take notes from Vienna's progressive affordable housing system, and with the right financial guidance and support, America can match up with some of Europe's public housing success.

[social_warfare]

UPDATE: Assistance Needed For Renters Across The Country

APOA advocates helped secure key victories in COVID-19 relief legislation including $25 billion in funding for the Emergency Rental Assistance program that will assist households that are unable to pay rent and utilities due to the COVID-19 pandemic.

With many renters accruing debt too great to be repaid and more than 40% of rental units owned by ‘mom and pop’-operated small businesses, many of which have been struggling to pay their bills and maintain their properties—timely distribution of rental assistance funds is critical to stabilize housing and keep families in their homes.

The Departments of Treasury and HUD must allocate the funds as quickly as possible and provide clear guidance to state and local governments when distributing federal rental assistance funds—as well as flexibility for landlords to obtain resident consent—to ensure that funds will be paid directly to the property owner on behalf of the resident and that the financial obligations of the property are met.

Rental assistance is necessary to pull the country back from the brink of a housing and financial crisis.

Learn More: See the Emergency Rental Assistance program eligibility requirements and access Frequently Asked Questions (FAQ) regarding program requirements

BACKGROUND

Most recently, on January 20, the Biden Administration extended the federal ban on evictions through March 2021 with an executive action.

Previously, on December 21, 2020, Congress passed an additional round of COVID-19 relief legislation that included funding for rental assistance.

Before, on September 4, 2020, the Centers for Disease Control and Prevention (CDC) declared a “temporary halt to residential evictions to prevent the further spread of Covid-19.” This eviction moratorium applies to all residential housing. Further, it applies to all renters who self-certify they meet four criteria. The criteria are:

- Make less than $99,000 (single) or $198,000 (married); This is expected to cover more than 95% of all renters

- Have used their best efforts to obtain rental assistance;

- Are unable to pay full rent due to loss of household income, hours or wages, lay-offs, or extraordinary out of pocket medical expenses; note this does not have to be COVID-related AND

- If evicted, would likely become homeless or need to move in to a residence that is shared by other people in close quarters

On May 15, 2020, The House of Representatives passed the HEROES Act which included substantial rental assistance, however the new eviction moratorium covers a much larger population of renters, around 95%, placing the vast majority of housing providers in jeopardy.

[social_warfare]

Buttigieg On Biden Administration’s Priorities For Transportation Department

Read the original article by Alisa Chang at NPR.

CHANG: OK. Let's talk a little bit about - more about what you'll be dealing with when you're confirmed, if you're confirmed as transportation secretary. Public transit systems throughout the country have been struggling for years and then even more so during this pandemic because ridership has further declined in many regions. Where do you even start to try to reinvigorate these systems in a post-pandemic world?

BUTTIGIEG: Well, it starts with the president's rescue package, which identifies $20 billion to support our transit agencies that have taken such a blow. But the reality is just trying to prop them up or get back to pre-COVID levels isn't really good enough when you consider the need for us to have stronger transit systems. It's important for safety. It's important for climate. It's important for economic growth. And it's important for equity because we know that in many parts of the country, there are transit deserts, disproportionately in Black, brown and tribal communities that have cut people off from economic opportunity. But again, if we get this right, this is a great example of the kind of investment that really does pay for itself because it unlocks opportunity. It gives people alternatives for how to get around. And it's going to make our economy and our communities stronger.

We believe, along with millions of Americans, that the dream of ownership is a dream that’s worth protecting. If you agree, we encourage you to add your name to our petition.

Are You and Your Partner Ready to Buy a House Together?

Read the original article by Christy Bieber at Nasdaq.com.

With mortgage rates near record lows, many Americans are shopping for a home right now -- even though prices have also been driven up in many parts of the country.

If you're hoping to score a mortgage at one of the lowest rates in history and you're financially ready to become a homeowner, you may be wondering if it makes sense to find a real estate agent and begin your search.

But if you're half of a couple, there's another thing you have to consider: whether you and your partner are ready to buy a house together and commit to a major joint financial obligation.

We believe, along with millions of Americans, that the dream of ownership is a dream that’s worth protecting. If you agree, we encourage you to add your name to our petition.

2021 – The Year For The Home Buyer And Seller

Read the original article by David H. Stevens at George Mason Mortgage.

In my almost forty years in the real estate and mortgage finance business, there have been a variety of cycles that have impacted housing. From the oil patch crisis in the eighties, the dot com bubble of 2000, to the Great Recession of 2008, and the most incredible year we just completed, homeowners, housing, and mortgage finance have seen its ups and downs.

The truth behind these market changes is that facts and data matter to markets. Housing is different from other goods and services. Yes, housing is about shelter and that makes it a national treasure that Presidents from both parties have highlighted over the many decades past, but it is far more than that. Housing is the single greatest contributor to wealth in America and when you combine that with the proper market conditions, the ability to build long-term, sustainable, intergenerational wealth can be accelerated.

The fact is, and what many don’t realize, home is where the majority of Americans have the greatest wealth...

We believe, along with millions of Americans, that the dream of ownership is a dream that’s worth protecting. If you agree, we encourage you to add your name to our petition.

National Association of REALTORS®

COVID-19 Assistance: National Association of REALTORS®

Federal Student Aid

COVID-19 Assistance: Federal Student Aid

Federal Housing Finance Agency

COVID-19 Assistance: Federal Housing Finance Agency

Housing & Urban Development

COVID-19 Assistance: Housing & Urban Development (HUD)

Consumer Financial Protection Bureau

COVID-19 Assistance: Consumer Financial Protection Bureau (CFPB)

What Does A Biden Presidency Mean For Your Tax Bill?

It’s taken a few days longer than expected, but early this morning, every major news network called the 2020 election in favor of former Vice President Joe Biden, who will become the 46th President of the United States. This news appears to have not been particularly well received by the 45th President, the incumbent Donald Trump, who has shown no signs that he’ll concede any time soon, choosing instead to launch allegations of voter fraud and promise legal action.

Eventually, this whole thing will get sorted out. And once the legal process is complete, if it does indeed reveal that Biden is next in line, many Americans will be asking the same question: are my taxes going to change?

It’s a valid question, because Biden has not hidden the fact that he intends to raise taxes by nearly $3.5 trillion over the next ten years on corporations and individuals earning more than $400,000 annually. As a result, high earners have a right to be nervous about a Biden presidency. At the same time, Biden has proposed a package of incentives aimed at cutting taxes for lower-income taxpayers, including refundable credits for everything from paying childcare costs to buying a home. Thus, for some, news of a Biden victory could mean more money in their pockets come tax time.

Why we need supply-side housing interventions

Stay-At-Home Orders Drive Broadband Expansion

Identified as a federal policy priority in 2009, broadband, or high-speed internet, remains one of the top infrastructure issues facing the country. However, as families continue to work and learn from home, it’s more essential than ever to invest in smart broadband policy for all communities. Luckily, government programs and relief packages are providing a new path for states to improve wireless in rural areas where broadband has not historically been available.

The $150 billion Coronavirus Aid, Relief, and Economic Security (CARES) Act, approved on March 27, 2020, is just one example. $2 billion of the CARES was earmarked to provide support for the transition to fully remote life, including distance learning, telehealth, and broadband expansion. Over 25 states took advantage - including: Alabama, California, Georgia, Idaho, Iowa, Kansas, Mayland, Michigan, Mississippi, Missouri, Montana, Nevada, New Hampshire, New York, North Carolina, North Dakota, Oklahoma, Oregon, South Carolina, Utah, Vermont, Virginia, West Virginia, and Wisconsin.

State, local, and tribal governments were eligible to apply for tech/broadband-specific grants. However, there are some key restrictions for this funding - which can only be used:

- Programs that are directly connected to COVID-19

- Have no previous budget allocated/ approved prior March 27.

- On Dec. 30, 2020, unused funds will revert to the federal government.

Other government programs have ramped up pre-established programs to provide needed relief during the pandemic. On Thursday, October 29th, the Federal Communications Commission (FCC) launched the first phase of its new Rural Digital Opportunity Fund auction, which will target over six million homes and businesses in unserved census blocks. The auction will provide internet companies with $20 billion in subsidies over the next 10 years and hopes to connect roughly 10 million Americans who don’t have any internet access or are on slow speeds.

The Department of Agriculture (USDA) has also launched a smaller rural broadband pilot. In September and October, the agency announced over $516 million in ReConnect rural broadband grants and loans, drawing from a $550 million pot that Congress authorized last December.

NAR Launches New “Fairness is Worth Fighting For” Campaign

A sad truth? Too many people are denied access to the future that properties can make possible. That’s the driver behind the National Association of REALTORS’ (NAR) newly launched “Fairness is Worth Fighting For” consumer advertising campaign - aimed to make fair housing a reality for all.

NAR’s Commitment to Change

NAR has a deeply rooted commitment to establish codes that set a higher standard for fairness in housing than any other federal law. Since 1997 NAR has funded “That’s Who We R,” a 22 year-long campaign designed to raise awareness and drive government legislation modifications.

The fair housing campaign is packed with persuasive video, digital, and social media materials that are designed for the public to spread awareness and bring the “fight for fair” into their own lives.

“Together we’ll hold each other accountable until the fight for fair is won. Because this ad won’t end discrimination in real estate. People will.”

At the beginning of the year, NAR released a Fair Housing Action Plan designed to ensure that all 1.4 million REALTORS® are protecting housing rights in their own neighborhoods. The Action Plan commits NAR to:

- Work closely with State Association Executives to ensure that state licensing laws include effective fair-housing training requirements and hold real estate agents accountable to their fair housing obligations;

- Launch a Public-Service Announcement Campaign that reaffirm NAR’s commitment to fair housing, and how consumers can report problems;

- Integrate fair housing into all REALTOR® conferences and engagements (to include a fair housing theme throughout the May Midyear Meeting;

- Explore the creation of a voluntary self-testing program, in partnership with a fair housing organization, as a resource for brokers and others who want confidential reports on agent practices so they can address problems;

- Create more robust fair housing education, including unconscious-bias training, and education on how the actions of REALTORS® shape communities.

- Conduct a national study to determine what factors motivate discrimination in sales market

- Profile leaders who exemplify the best fair housing practices and workplace diversity

- Develop materials to help REALTORS® provide consumers with information on schools that avoids fair housing pitfalls.

These Fair Housing efforts demonstrate the value and service that REALTORS® bring to their clients and communities in regards to homeownership.

If you experience or witness discrimination in real estate, we urge you to report it.

Visit Everything you need to know to file a housing discrimination complaint with the HUD if you have any questions.

How Much Does Flood Insurance Cost?

Read the original article by John Egan and Amy Danise on Forbes

Flooding ranks as the costliest, most common natural disaster in the U.S. Yet standard homeowners and renters insurance don’t cover flood damage, and most commercial property insurance policies also exclude floods.

So how do you protect your property and belongings from the financial pit of flooding? You can purchase a separate flood insurance policy from the National Flood Insurance Program (NFIP) or from a private insurer.

How to Get NFIP Flood Insurance

The NFIP, managed by FEMA, offers federally backed flood insurance sold through more than 60 insurance companies and through an initiative called NFIP Direct.

NFIP policies are available in more than 22,000 communities that participate in the program. The program is the primary provider of residential flood insurance in the U.S. It covers more than 5 million homes and businesses, mainly in flood-prone coastal regions...

Homeowner Insurance Rates Are Rising

Homeowners’ insurance rates are steadily rising across the country. A surge of natural disasters in 2019 and 2020 have resulted in huge insurance payouts, and rate hikes soon followed. The NOAA National Centers for Environmental Information (NCEI) shows that “in 2020 alone, the U.S. experienced 22 billion-dollar disasters.” As a result, many homeowners can expect to pay more for insurance. The National Association of Insurance Commissioners notes “home insurance rates are up almost 47 percent in the last 10 years.”

Homeowners’ insurance rates are steadily rising across the country. A surge of natural disasters in 2019 and 2020 have resulted in huge insurance payouts, and rate hikes soon followed. The NOAA National Centers for Environmental Information (NCEI) shows that “in 2020 alone, the U.S. experienced 22 billion-dollar disasters.” As a result, many homeowners can expect to pay more for insurance. The National Association of Insurance Commissioners notes “home insurance rates are up almost 47 percent in the last 10 years.”

- Average premium: $1,826

- Increase over 2019: 3%

- Average premium: $1,749

- Increase over 2019: 6%

- Average premium: $1,405

- Increase over 2019: 4%

- Average premium: $2,364

- Increase over 2019: 3%

- Average premium: $711

- Increase over 2019: 2%

- Average premium: $1,414

- Increase over 2019: 1%

- Average premium: $1,713

- Increase over 2019: 0%

- Average premium: $1,341

- Increase over 2019:8%

- Average premium: $940

- Increase over 2019: 5%

- Average premium: $1,284

- Increase over 2019: 3.5%

- Shop Around: It can be time-consuming to investigate various insurers, but the money you can save might be worth it. Start by checking with the National Association of Insurance Commissioners (NAIC). Here you can find information to help you choose an insurer in your state. You can also check with your state insurance department for rate comparisons. While it’s advisable to get multiple quotes to compare prices, make sure the providers are highly rated for serving customers filing claims.

- Raise Your Deductible: A deductible is the sum of money you pay toward a loss before your insurance begins payment on a claim. If you have a higher deductible, you can save money on your premiums. The Insurance Information Institute notes, “Most insurance companies recommend a deductible of at least $500. If you can afford to raise your deductible to $1,000, you may save as much as 25 percent.” Remember, you may have a separate deductible for specific disaster-related damage like windstorms, earthquakes, and hail.

- Combine Your Home and Auto Policies: Often, if you bundle your insurance policies (home and auto) with one company you can save 25 percent in premiums. It is still smart to make sure your total price is lower with the bundled policies than if you were to buy two policies from two different companies.

- Make Disaster Resistant Home Improvements: You may be able to save on premiums if you make disaster resistant home improvements. You should check with your insurance agent to find out which upgrades, if any, can save you money. Each disaster comes with its own set of appropriate upgrades. Homeowners in wildfire-prone areas like California and Arizona will benefit from different upgrades than homeowners living in hurricane-prone areas like North Carolina, Louisiana, and Florida.

- Improve Your Credit Score: Having a good credit score can reduce your insurance costs. To make sure your credit history is solid you should pay your bills on time, keep your credit balances as low as possible, and limit your open credit accounts.

Teleworking in a parking lot. School on a flash drive. The coronavirus prompts new urgency for rural Internet access.

Read the original article by Meagan Flynn in The Washington Post. Jason Onorati moved to rural Powhatan, Va., 23 years ago, when he didn’t need the Internet to raise a family. He lives with his young…

Teleworking in a parking lot. School on a flash drive. The coronavirus prompts new urgency for rural Internet access.

Read the original article by Meagan Flynn in The Washington Post.

Jason Onorati moved to rural Powhatan, Va., 23 years ago, when he didn’t need the Internet to raise a family.

He lives with his young son and his 2-year-old granddaughter on a gravel dead-end road on the edge of town, one of many pockets of rural America that lack reliable WiFi. Here, there is no access to video calls, no Netflix or online billing, except via cellphone. Teleworking, online doctor’s appointments and remote school are nearly impossible.

“I’m three-tenths of a mile from the road, which is why I can’t get Comcast,” Onorati said. “They want to charge by the foot. We’re talking thousands of dollars.”

The coronavirus pandemic has drawn new attention to this long-standing problem, with local and federal lawmakers and candidates in Virginia demanding funding and legal changes to bring broadband to an estimated half-million state residents.AD

In a debate last month, Sen. Mark R. Warner (D-Va.) compared the need for nationwide broadband deployment to rural electrification in the 1930s. His Republican opponent, Daniel Gade, compared it to the construction of the country’s interstate highway network in the 1950s...

It’s Time To Get Smart About Infrastructure

Read the original article by Chris Turlica by Forbes.

It’s a running joke in Beltway circles that every week is Infrastructure Week, but while the Senate remains deadlocked over the next round of coronavirus stimulus spending, analysts believe that major infrastructure investments might be the key to putting the global economy back on track. Both U.S. presidential candidates have pledged to spend heavily on infrastructure, and industry groups are also calling for big investments in bridges, highways and other major infrastructure projects to spur a U.S. economic revival.

Such spending is long overdue. A third of Americans say roads in their neighborhoods badly need repairs, and half of rural roads are rated poor to fair. Put all 54,000 of our nation’s structurally deficient bridges end to end, and they’ll stretch from Manhattan to Miami Beach. At least 2,170 of our 15,500 high-hazard dams are dangerously deficient. And with 240,000 water-main breaks a year, we annually pour 2 trillion gallons of drinking water straight down the drain.

Frankly, the state of America’s infrastructure is shocking. But therein lies the rub: With so much of our infrastructure in decay, how can we track all the work that needs to be done? At current rates of repair, it would take decades to patch up those deficient bridges — so where should we start, and which bridges should we repair first? Which structures merely need a coat of paint, and which ones need to be completely rebuilt? With vast sums at stake, how will we decide how the money gets spent?

To find the answer, look at the five-mile Mackinac suspension bridge between Michigan’s upper and lower peninsulas. Since 2016, researchers have installed scores of tiny wireless sensors on “Big Mac.” This year, they will fit thousands more. Powered by the vibrations of passing traffic, the sensors constantly gather information about traffic patterns, wind levels and the condition of the bridge itself, giving inspectors a torrent of invaluable data about the bridge’s safety and pinpointing exactly where and when repairs are needed...

The Pandemic Threatens The Already Vulnerable Affordable Housing Crisis

Read the original article by Jennifer Castenson on Forbes

The perfect storm of affordable housing crisis is brewing right now: a threat made up of the already low supply that is hitting the increasing post-pandemic demand head on.

Before the pandemic, supply was an issue. The National Low Income Housing Coalition published the GAP report in late 2019 that shows a shortage of seven million affordable homes for low-income households at or below the poverty guidelines, or 30% of the area median income.

So, now, those already taxed supply issues are being further pressured by the pandemic.

Jay Parsons, vice president of multifamily optimization and deputy chief economist at RealPage RP -2.6%, a property management software company, forecasts that the total apartment supply will remain high through 2021 due to the pipeline of projects that were approved and under way prior to COVID. But, he cautions that the pipeline is thinning out and there will likely be a large drop off of completions by 2022...

Average 30-year mortgage rate for purchase loans falls to another all-time low

30-year fixed loan now 5 basis points below the original record set in September

Read the original article by Alex Roha on HousingWire.

The average U.S. mortgage rate for a 30-year fixed loan fell to 2.81% this week, the lowest in Freddie Mac’s survey history, the mortgage giant said in a report on Thursday. The rate fell six basis points from the week prior and is now five basis points lower than the original all-time low set in mid-September.

The average fixed rate for a 15-year mortgage was 2.35%, falling from last week’s 2.37% — matching the record set three weeks ago...

Housing Affordability Weakens in August 2020 as Home Prices Rose Faster than Median Family Incomes

Read the original article by Michael Hyman from NAR At the national level, housing affordability declined in August 2020 compared to a year ago and fell compared to July, according to NAR’s Housing Affordability Index.…

Housing Affordability Weakens in August 2020 as Home Prices Rose Faster than Median Family Incomes

Read the original article by Michael Hyman from NAR

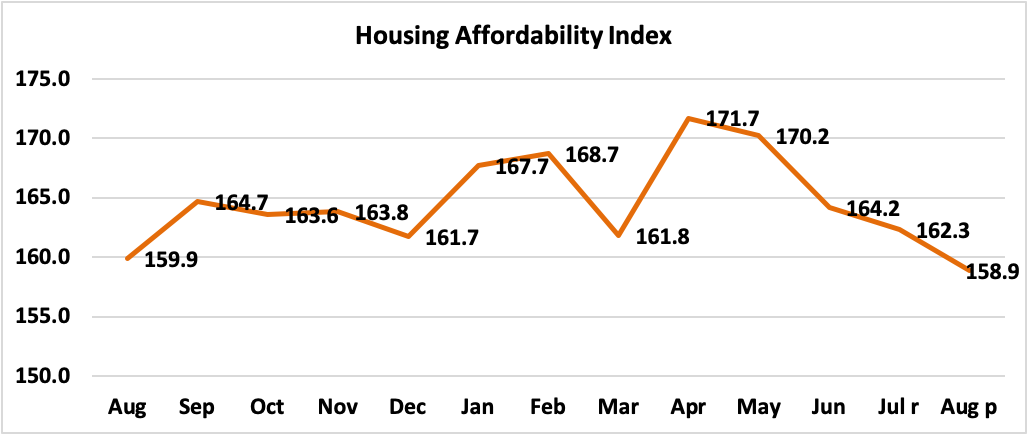

At the national level, housing affordability declined in August 2020 compared to a year ago and fell compared to July, according to NAR’s Housing Affordability Index. Affordability dipped in August compared to August as the median family income rose by 2.2% while the median home prices rose by 11.7%. The effective 30-year fixed mortgage rate1 fell to 3.00% this August from 3.08% in July. Mortgage rates are at all-time lows compared to a year ago at 3.66%.

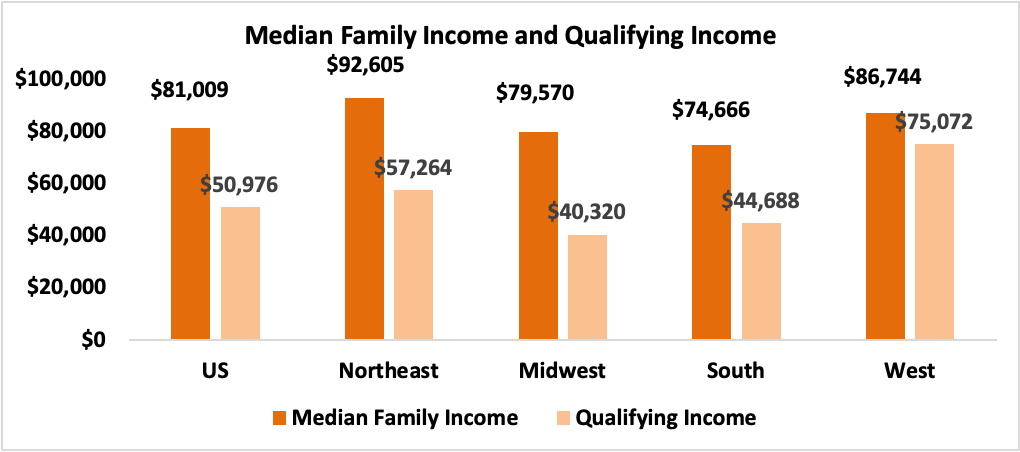

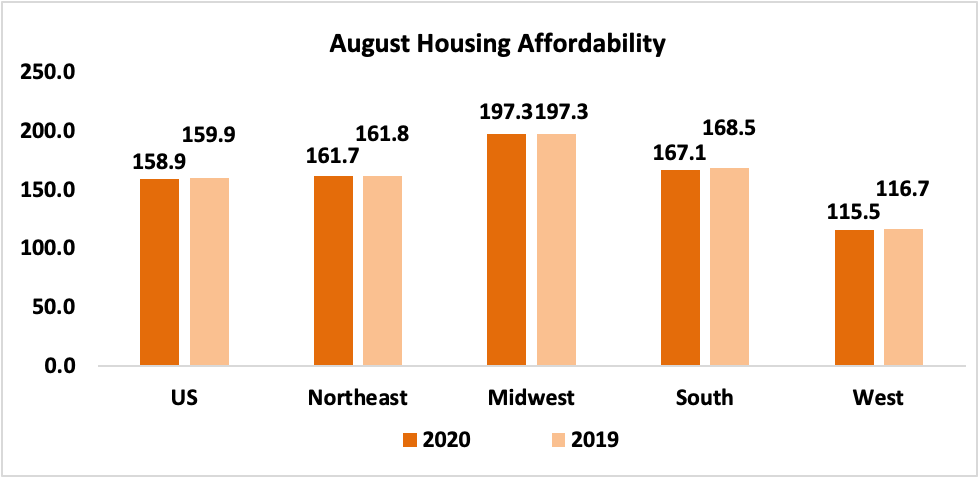

As of August 2020, the national and regional indices were all above 100, meaning that a family with the median income had more than the income required to afford a median-priced home. The income required to afford a mortgage, or the qualifying income, is the income needed so that mortgage payments make up no more than 25% of family income. The most affordable region was the Midwest, with an index value of 197.3 (median family income of $79,570 which is almost more than twice the qualifying income of $40,320). The least affordable region remained the West, where the index was 115.5(median family income of $86,744 and the qualifying income of $75,072). For comparison, the index was 167.1 in the South (median family income of $74,666 and the qualifying income of $44,688) and 161.7 in the Northeast (median family income of $92,605 with a qualifying income of $57,264).

While homes are typically affordable, housing affordability2 declined from a year ago in all regions, except in the Midwest where there was no change. The Northeast HAI had a modest decline of 0.1% followed by the South HAI with a dip of 0.8%. The West HAI had the biggest drop of 1.0%.

Affordability is down in all of the four regions from last month. The South HAI had a decline of 1.2% followed by the West HAI with a dip of 1.3%. The Midwest HAI had a decline of 1.7% followed by the Northeast HAI with the biggest drop of 5.8%.

Nationally, mortgage rates were down 66 basis points from one year ago (one percentage point equals 100 basis points). The median sales price for a single-family home sold in August in the US was $315,000 up 11.7% from a year ago, while median family incomes rose 2.2 % in 2020 from one year ago.

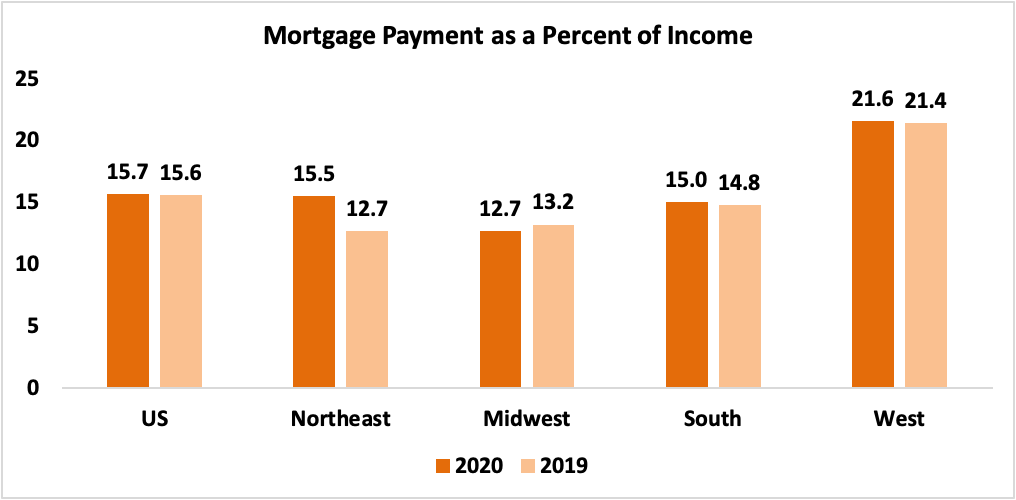

Even with lower mortgage rates compared to one year ago, the payment as a percentage of income rose modestly to 15.7% this August from 15.6% from a year ago. Regionally, the West has the highest mortgage payment to income share at 21.6% of income. The Northeast had the second highest share at 15.5% followed by the South with their share at 15.0%. The Midwest had the lowest mortgage payment as a percentage of income at 12.7%. Mortgage payments are not burdensome if they are no more than 25% of income.3

This week the Mortgage Bankers Association reported that for the week ending October 2, mortgage applications increased 4.6 from the week prior. Inventory levels are extremely low so more housing supply is needed to help tame price growth. New home sales are on the rise. Consumers can still take advantage of borrowing while rates are historically low.

What does housing affordability look like in your market? View the full data release.

The Housing Affordability Index calculation assumes a 20% down payment and a 25% qualifying ratio (principal and interest payment to income). See further details on the methodology and assumptions behind the calculation.

1 Starting in May 2019, FHFA discontinued the release of several mortgage rates and only published an adjustable-rate mortgage called PMMS+ based on Freddie Mac Primary Mortgage Market Survey. With these changes, NAR discontinued the release of the HAI Composite Index (based on 30-year fixed-rate and ARM) and starting in May 2019 only releases the HAI based on a 30-year mortgage. NAR calculates the 30-year effective fixed rate based on Freddie Mac's 30-year fixed mortgage contract rate, 30-year fixed mortgage points and fees, and a median loan value based on the NAR median price and a 20% down payment.

2 A Home Affordability Index (HAI) value of 100 means that a family with the median income has exactly enough income to qualify for a mortgage on a median-priced home. An index of 120 signifies that a family earning the median income has 20 percent more than the level of income needed pay the mortgage on a median-priced home, assuming a 20% down payment so that the monthly payment and interest will not exceed 25% of this level of income (qualifying income).

3 Total housing costs that include mortgage payment, property taxes, maintenance, insurance, utilities are not considered burdensome if they account for no more than 30% of income.

How Biden’s $15,000 tax credit plan for first-time homebuyers could be a game-changer

Read the original article by Zach Wichter on Bankrate

With less than a month until Election Day — and voting already underway in many states — housing hasn’t been a front-burner issue so far. But one candidate’s plan to encourage homeownership with tax credits could make a big difference in some parts of the country.

As part of his campaign platform, former Vice President Joe Biden said he’d put forward legislation that would provide $15,000 in tax credits to first-time homebuyers. That could be a game-changer in some markets, especially in the South and Midwest where property values are generally lower than in coastal cities. It could mean that some people may be able to afford to buy a house years before they thought they would.

Bankrate spoke to Lawrence Yun, chief economist at the National Association of Realtors about Biden’s proposal. Yun said President Trump has not made a similar pitch, but emphasized that NAR does not favor any political party or candidate...

Fair Housing Act 101

What is Fair Housing Act and who does it cover?

Everything you need to know to file a housing discrimination complaint with the Department of Housing and Urban Development (HUD)

If you believe you have experienced discrimination in renting or buying a home, getting a mortgage, or other housing-related activities because of your race, color, national origin, religion, sex, familial status, or disability, you may…

Everything you need to know to file a housing discrimination complaint with the Department of Housing and Urban Development (HUD)

If you believe you have experienced discrimination in renting or buying a home, getting a mortgage, or other housing-related activities because of your race, color, national origin, religion, sex, familial status, or disability, you may file a complaint with HUD. HUD will investigate your complaint for free.

Throughout the investigation, HUD will try to help both sides resolve the complaint. If no agreement is reached, and HUD’s investigation leads to a finding that discrimination has likely occurred, it may bring a legal action on your behalf. HUD will seek to address the harm caused by the discrimination, and to prevent future discrimination, by seeking compensation, changes to policies and procedures, and/or training.

Fair housing complaints can be filed against:

- Property owners, property managers, developers, real estate agents, mortgage lenders, homeowners associations, insurance providers, and others who affect housing opportunities

What to know before filing a complaint?

- Who can file?

- Anyone who has been or will be harmed by a discriminatory housing practice may file a complaint.

- How much does it cost to file a complaint?

- Filing a complaint through HUD is completely free - both for individuals and community groups

- Is there a time limit for filing?

- You must file your complaint within one year of the last date of the alleged violation.

- Can you get in trouble for filing a complaint?

- Retaliation is illegal. You cannot be punished for filing a complaint.

- Are there resources to help you file?

- HUD provides a toll-free teletypewriter (TTY) line: 1-800-877-8339. You can also ask for other disability-related assistance when you contact HUD. HUD will accept complaints made in any language, and will provide interpreters upon request.

Be prepared to provide:

- Your name & address

- The name and address of the person(s) or organization your complaint is against;

- The address or other identification of the housing or program involved;

- A short description of the event(s) that cause you to believe your rights were violated; and

- The date(s) of the alleged violation.

4 Ways to submit a complaint:

- Online Portal

- Phone

- Mail

- If utilizing email, phone, or mail, HUD recommends you direct the complaint to one of HUD’s regional offices utilizing this form.

How HUD’S Counseling Services Can Help Homeowners and Home Buyers

BY TANYA SVOBODAJ

Buying and owning a home is a daunting prospect in the best of times – and the uncertain climate of the economy due to COVID-19 can make it feel downright unachievable. The good news is that there are professionals trained to help you navigate your home related worries. Acting Federal Housing Commissioner Len Wolfson said in a statement, to the U.S. Department of Housing and Urban Development (HUD), “In the midst of the COVID-19 pandemic, HUD-approved counselors are there to assist millions of homeowners and renters nationwide and help them keep a roof over their heads.”

Homeowners and potential homebuyers looking for guidance amidst the uncertainty can benefit from the $40 million in housing counseling grants awarded by HUD on June 16th. HUD notes these grants, “Will directly support the housing counseling services provided by the 204 HUD-approved local housing counseling agencies, national and regional organizations and housing finance agencies (SHFAs).”WHY WORK WITH A HUD COUNSELOR?

A housing counselor is an individual certified through The HUD Housing Counseling Certification Examination who can help potential homebuyers understand the buying process, help current homeowners understand how to avoid foreclosure, and help seniors and individuals with disabilities make sound decisions about their monthly payments, among other things.

According to HUD, “In Fiscal Year 2019, HUD-approved housing counseling agencies served 1,015,911 households. Approximately 52 percent of those households were minorities, including 38 percent African American and 10 percent identified as multiple races. Additionally, 19 percent of households served were Hispanic.”

The latest grants were given preferentially to local counseling agencies serving individuals in designated Opportunity Zones, or “economically distressed communities.”WHAT COUNSELING SERVICES ARE AVAILABLE?

While there are a variety of services offered through HUD’s Housing Counseling Program, not all of them are free. Housing counseling agencies who participate in HUD’s Housing Counseling Program are not permitted to charge a fee for:

- Foreclosure prevention: There are a variety of programs administered through HUD for homeowners who are at risk of foreclosure or struggling with their mortgage payments. A complete list of these programs can be found on HUD’s website.

- Homeless counseling: HUD funds services to help individuals transition out of homelessness.

Housing counseling agencies are permitted to charge reasonable fees for other services such as:

- Pre-purchase education: HUD’s counseling services can help potential homebuyers understand how much they can afford, know their rights, shop for a loan, find homebuying programs, and walk them through the entire homebuying process from making a wish list to signing the closing papers.

- Reverse mortgage counseling: This service focuses on educating seniors about the viability of a reverse mortgage.

- Non-delinquency post-purchase counseling services

- Education to avoid mortgage scams

It’s important to make sure you’re using a HUD-approved agency to access these services. The National Association of REALTORS’® Protect Your Investment: A Guide For At Risk Homeowners urges people to: “Watch out for questionable companies who advertise that, for a minimal fee, they will assist homeowners by hiring a lawyer to defend the foreclosure in court or negotiate lender assistance on the borrowers’ behalf. You should contact a HUD-approved counseling organization before you pay or sign anything.”

If you demonstrate that you can’t afford the fees, the agency is required to waive the fee. HUD also requires all housing counseling agencies to provide an upfront explanation of their fee structure and the fee must be proportional to the service provided. If you feel a housing agency is not complying with these regulations you can contact HUD’s Office of Housing and Counseling.HOW CAN I ACCESS HUD’S COUNSELING SERVICES?

After gathering your basic financial and loan information – including mortgage statements, other monthly debt payments, and income details – you can find a HUD-approved agency in a variety of ways.

- Online: Using HUD’s approved housing counseling agencies search tool you can find an agency by state. You can narrow your search by searching specifically for a foreclosure avoidance counselor or a reverse mortgage counselor.

- By phone: You can access foreclosure advice from housing experts any time of day by calling (888) 955-HOPE (4673).

- Through the app: The free app, available for iPhone or iPad, offers contact information for approved agencies sorted by location and language.

HUD’s counseling services are a great resource for homeowners and homebuyers who are looking to educate themselves and make responsible choices in their pursuit of homeownership.

ASCE Infrastructure Report Card

Every four years, the American Society of Civil Engineers (ASCE) puts together a comprehensive assessment of the nation’s 16 major infrastructure categories in an Infrastructure Report Card. Using a simple A to F school report card format, the Report Card examines current infrastructure conditions and needs, assigning grades and making recommendations to raise them at both the National and State level.

The 16 categories include:

- Aviation

- Bridges

- Dams

- Drinking Water

- Energy

- Hazardous Waste

- Inland Waterways

- Levees

- Ports

- Public Parks

- Rail

- Roads

- Schools

- Solid Waste

- Transit

- Waste Water

The most recent report card was released in 2017. You can see how your state ranked here.

How High Are Property Taxes in Your State?

Read the original article by Janelle Cammenga on TaxFoundation.org

Today’s map takes another look at property taxes, this time focusing on states’ effective tax rates on owner-occupied housing. This is the average amount of residential property taxes actually paid, expressed as a percentage of home value.

Because property taxes are tied to housing values, it makes sense that the actual dollar amounts of property taxes tend to be higher in places with higher housing prices. This map takes housing value into account in order to give a broader perspective for property tax comparison.

States tax real property in a variety of ways: some impose a rate or a millage—the amount of tax per thousand dollars of value—on the fair market value of the property, while others impose it on some percentage (the assessment ratio) of the market value. While values are often determined by comparable sales, jurisdictions also vary in how they calculate assessed values...

Mortgage rates expected to increase, but for now, are setting record lows

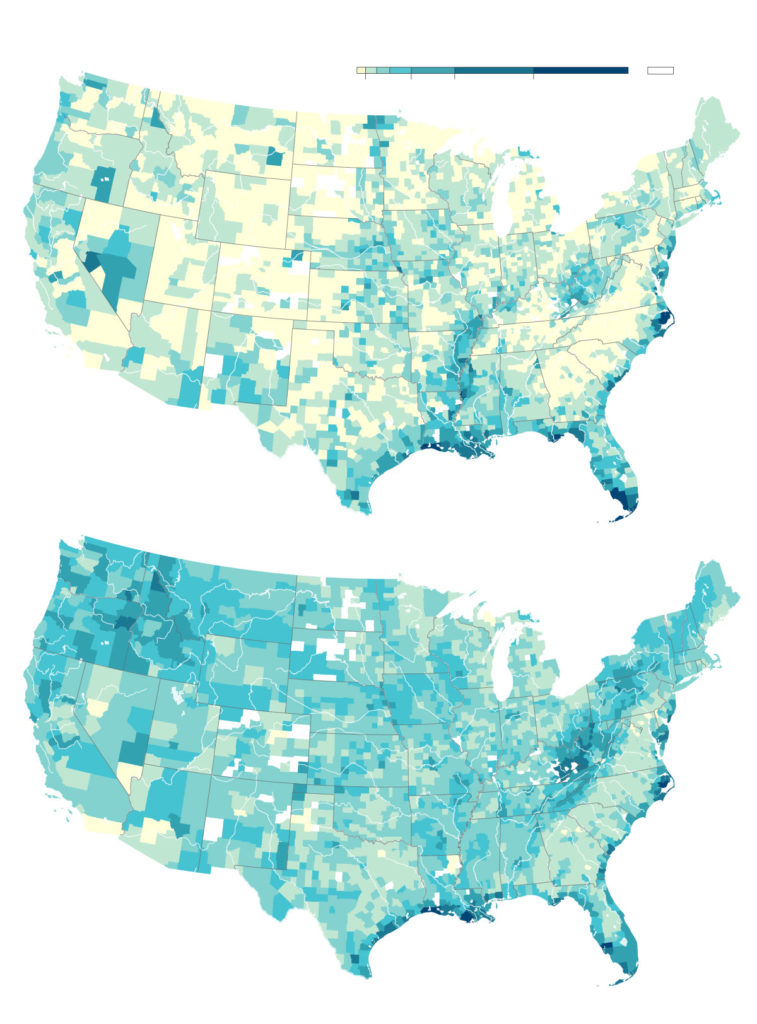

REDLINING IMPACT REARS ITS UGLY HEAD AGAIN THANKS TO COVID-19

Low-income communities hit hardest by both virus and economic struggles

BY ANTHONY SANFILIPPO

The COVID-19 pandemic has changed the American way of life as we knew it and has negatively impacted millions.

But no one group has felt a greater negative impact from the coronavirus than Black Americans.

Since the pandemic first forced the country to shut down last March, Black Americans have faced job loss, wage reduction, small business closures and community infections at a greater rate than any other race or ethnicity.

This has had a trickle-down effect on housing, as Black property owners and Black renters have struggled to make the financial payments necessary to keep roofs over their heads.

The struggle is real for Black developers as well, who after years of building their companies from the ground up on the shoulders of the need for affordable housing, are likely going to find themselves either shutting down operations or, in a best-case-scenario, starting all over again.

According to an article published by Bisnow, although 92.2 percent of market-rate apartment renters paid rent in June, nearly 25 percent of rent-stabilized units in New York did not.

This is an indicator that the nearly eight percent of renters in this country that aren’t able to afford their rent now because of the pandemic, are likely concentrated in specific areas of the country. And likelier still, into specific neighborhoods, or sections of major markets.

This is the result of ages old discrimination that the government tried to curb more than 50 years ago but is still impacting Black Americans today.

Redlining, which was a post-World-War II government mapping practice that basically segregated communities and allowed banks to discriminate against residents of predominantly Black neighborhoods when it came time to approve loans, was outlawed with the birth of the Fair Housing Act, signed into law in 1968.

However, while redlining doesn’t exist today, the effects of its impact on society more than a half century ago can still be felt, much like the aftershock of an earthquake.

Developers of color told Bisnow they still have hurdles to traverse today when getting loans to fund their projects. This often gets lost in the shuffle because there is a racial disparity when it comes to developers.

More than 13 percent of the country identifies as Black, only 1.3 percent of senior executives in commercial real estate are Black men and less than one percent are black women, according to a 2016 study from Florida A&M University.

Many Black developers have been able to build their business by either purchasing or building affordable housing. The draw toward affordable housing for Black developers is the result of the gap in wealth and equity that exists in America between whites and Blacks.

According to a report from the Brookings Institution in February, the average net worth of a white family is 10 times that of a Black family.

This disparity is largely the result of the housing policies that existed during pre- and post-World War II America.

Redlining, the practice of rating neighborhoods from most desirable to least desirable, ended up segregating Americans predominantly by race.

It became nearly impossible for people to get loans for the less desirable neighborhoods, and Black Americans were especially discriminated against, and couldn’t even become property owners in their own, segregated neighborhoods.

The Fair Housing Act of 1968 banned redlining, but the long-lasting impact of it is still felt more than 70 years later.

The homeownership gap in the United States between whites and Blacks is worse in 2020 than it was in 1968.

Add in the impact of COVID-19, and Black Americans are bearing the brunt of the damage economic damage being caused by the pandemic.

Not only were Black Americans more likely to be infected by the coronavirus and die from it, especially in major metropolitan areas where people live in much closer proximity to one another than in suburbs or even rural communities, but the neighborhoods that were hit hardest economically by the shutdown that occurred as the country tried to flatten the curve were in lower-income Black communities.

ACCORDING TO A REPORT FROM THE BROOKINGS INSTITUTION IN FEBRUARY, THE AVERAGE NET WORTH OF A WHITE FAMILY IS 10 TIMES THAT OF A BLACK FAMILY.

According to the Urban Institute, layoffs and furloughs from companies during the shutdown, adversely affected Black (and Latinx) workers, leading to more housing instability because these workers were more likely to be living paycheck-to-paycheck before the pandemic gripped the country.

In a city like New York, where whites are actually a minority, making up only 42.7 percent of the population, all of the city’s major developers and property owners are companies run by whites.